Simplify Your Tax Obligations: Expert NTN Registration Services for Salaried Individuals in Pakistan

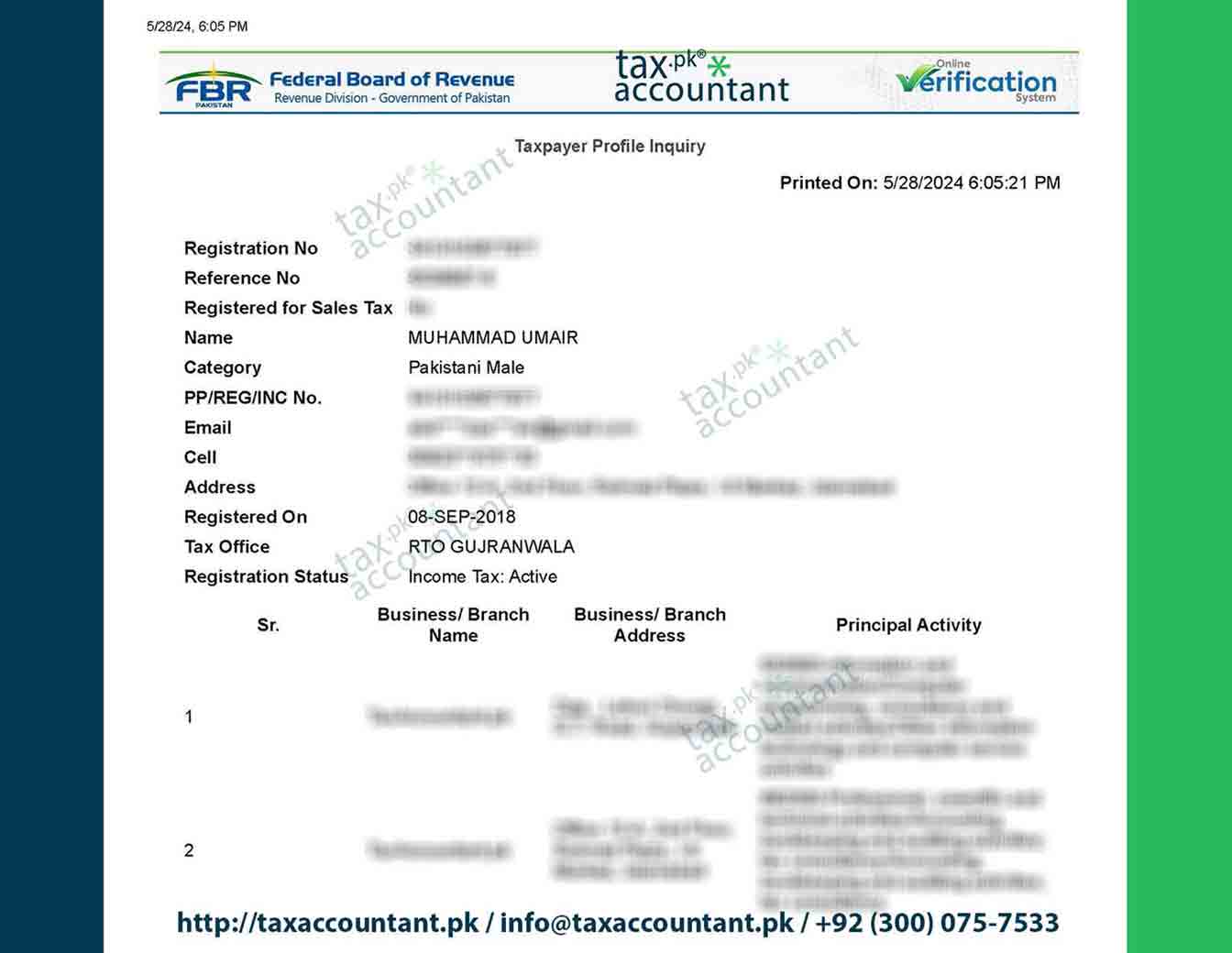

At TaxAccountant.pk, we recognize the importance of tax compliance for salaried individuals in Pakistan. Obtaining a National Tax Number (NTN) is a fundamental step in fulfilling your tax obligations and ensuring financial transparency. Our team of tax experts is dedicated to guiding you through the NTN registration process, making it simple, efficient, and stress-free.

Why Choose TaxAccountant.pk for NTN Registration:

- In-depth Tax Knowledge: Our experts possess comprehensive knowledge of Pakistani tax laws and regulations, ensuring your NTN application is accurate and compliant.

- Personalized Guidance: We offer personalized assistance throughout the registration process, addressing your specific questions and concerns.

- Efficient Application Processing: We handle all necessary documentation and communication with the Federal Board of Revenue (FBR), saving you valuable time and effort.

- Error-Free Submission: Our meticulous approach ensures your application is complete and error-free, minimizing delays and potential issues.

- Ongoing Tax Support: We provide continuous support with tax filings, compliance, and any tax-related queries you may have.

Benefits of NTN Registration for Salaried Individuals:

- Legal Compliance: An NTN is mandatory for filing tax returns and fulfilling your tax obligations as a salaried individual.

- Financial Transparency: Demonstrates your commitment to financial transparency and responsible citizenship.

- Tax Refunds: An NTN enables you to claim tax refunds for any excess tax deducted from your salary.

- Simplified Tax Filing: An NTN streamlines the tax filing process, making it easier and more convenient.

- Future Financial Benefits: An NTN may be required for various financial transactions, such as obtaining loans or applying for government schemes.

Liabilities & Considerations:

- Tax Obligations: Obtaining an NTN makes you liable for filing annual tax returns and paying any applicable taxes.

- Penalties for Non-Compliance: Failure to file tax returns or pay taxes on time can result in penalties and legal consequences.

- Accurate Record-Keeping: It’s crucial to maintain accurate records of your income and tax deductions for compliance purposes.

Required Documents for Salaried Individuals:

- Valid CNIC (Computerized National Identity Card)

- Proof of residence (utility bill, rent agreement, etc.)

- Latest salary slip

- NTN of your employer

Let us simplify your tax journey. Contact TaxAccountant.pk today for expert NTN registration services and comprehensive tax support.

FAQs

Is it mandatory for all salaried individuals to have an NTN?

Yes, if your income exceeds the taxable threshold, you are required to obtain an NTN.

Can I apply for an NTN online?

Yes, you can apply online through the FBR’s IRIS portal, and we can assist you with the process.

How long does it take to get an NTN?

The processing time varies, but we typically obtain NTNs within a few working days.

Do I need to renew my NTN?

No, your NTN is valid for life unless you change your status from salaried to a business owner.

What if I change jobs?

You need to update your employment information with the FBR through their online portal or by visiting a tax facilitation center.

1 Comment

drover sointeru

whoah this blog is fantastic i really like studying your posts. Keep up the good paintings! You already know, a lot of individuals are looking round for this info, you can aid them greatly.