Unlocking Value: A Deep Dive into Capital Taxation in Pakistan In the intricate world of...

Blog

“7 Powerful Reasons Why Understanding Professional Tax Boosts Your Career Confidence”

The Lesser-Known Levy: Understanding Professional Tax in Pakistan When discussing taxation in Pakistan, the conversation...

Empower Your Business: 6 Essential Insights into Corporate Tax

Understanding Corporate Tax: A Comprehensive Guide for Businesses Corporate tax plays a vital role in...

Empower Your Understanding: The 7 Things About Service Tax

Service Tax: A Deep Dive into its Dynamics and Economic Impact Introduction In the intricate...

Empower Public Good: 10 Insights into Effective Excise Duty

The Hidden Hand in Your Pocket: Understanding Federal Excise Duty in Pakistan In the elaborate...

Optimize Your Intellect: 5 points Comprehensive Guide to Smart Tax Exemptions

Navigating the Labyrinth of Tax Exemption: A Comprehensive Guide for Individuals and Businesses ...

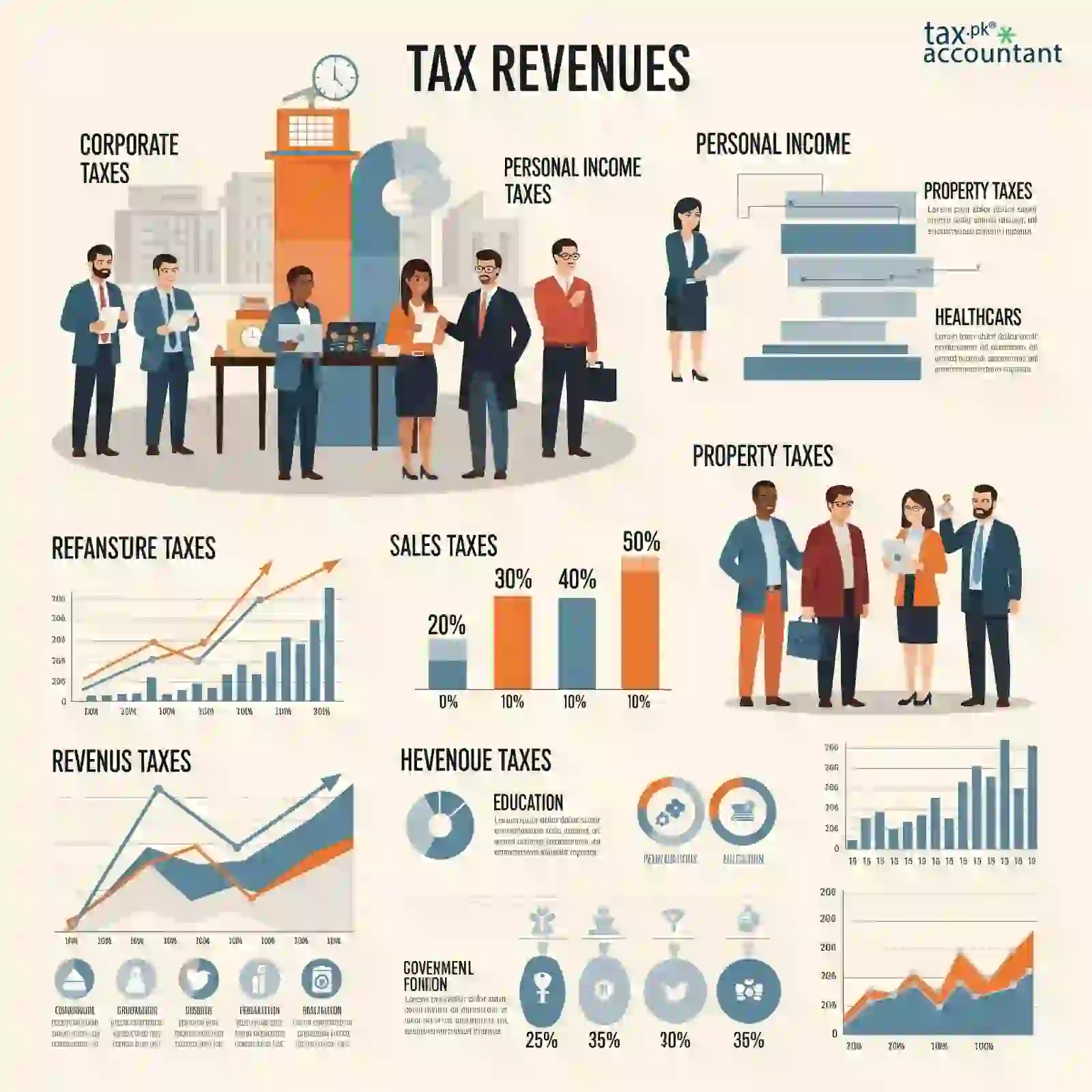

The Super Guide on Tax Revenue: Where Does It All Go?

The Lifeline of Nations: Understanding the Dynamics of Tax Revenues Tax revenues are more...

Achieve Clarity: Essential Insights for Your Normal Tax Year

The Rhythm of Revenue: Understanding Your Normal Tax Year in Pakistan For every individual, business,...

10 Empowering Truths About Tax Evasion Every Pakistani Should Know

Tax Evasion in Pakistan: A Hidden Crisis Undermining the Nation Introduction Tax evasion is a...

Subscribe to Get Newest Updates

We bring you the latest tax updates you do not miss anything.