Capital Tax Value in Pakistan: Capital tax value in Pakistan is becoming more and more...

Blog

Professional Tax in Pakistan

Professional Tax in Pakistan for Businesses and Professionals in 2025 When it comes to Pakistan’s...

Corporate Tax

Corporate Tax in Pakistan What You Need to Know About Pakistan’s Corporate Tax Corporate taxes...

Service Tax in pakistan

Service Tax in Pakistan: What You Need to Know About the Service Tax in Pakistan...

Excise Duty-2025

Federal Excise Duty (FED) for 2025 Pictured: A Pakistani businessman looking over excise duty paperwork...

Understand the Tax Exemptions

Tax Exemption in Pakistan 2025 According to the law in Pakistan, tax exemption is one...

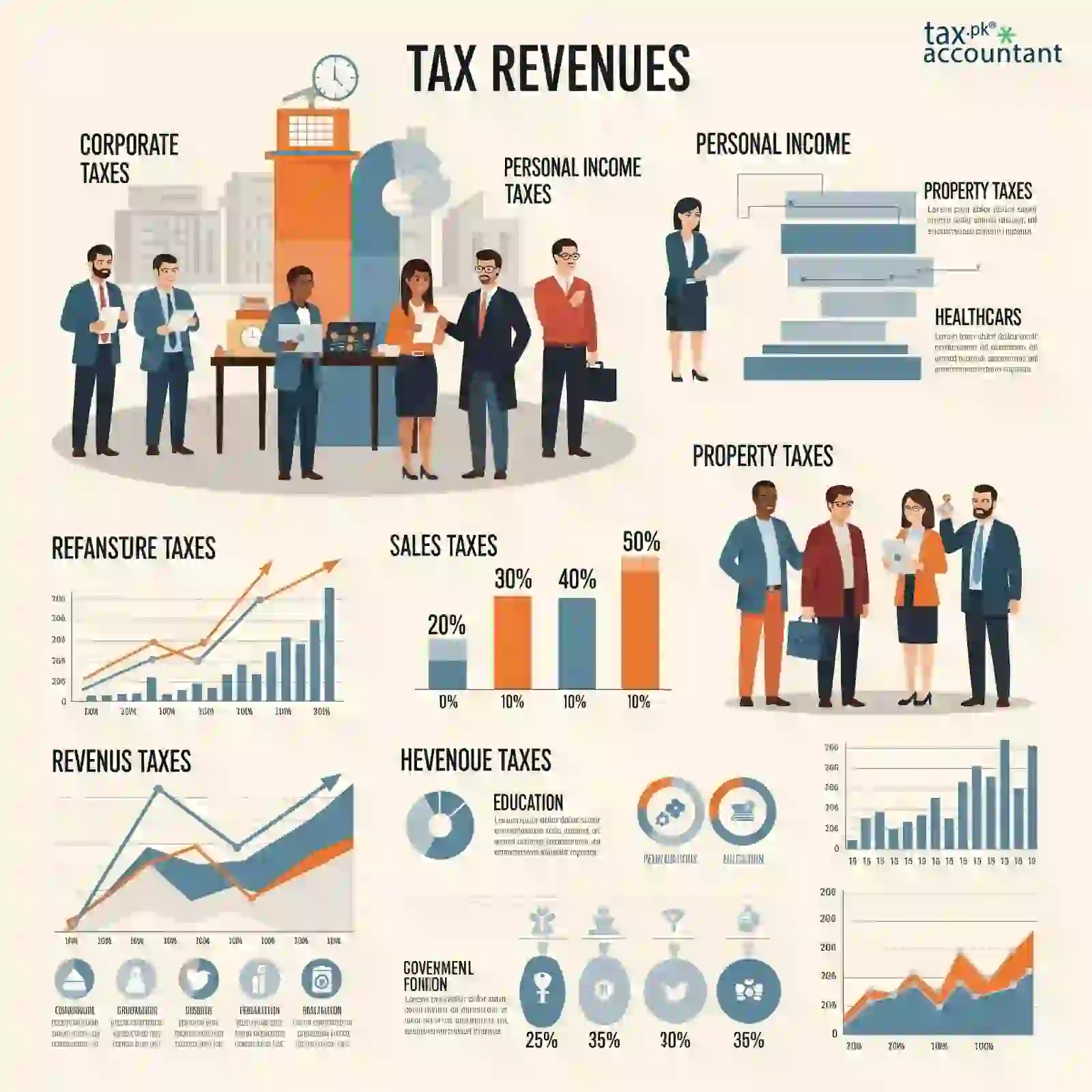

The Super Guide on Tax Revenue: Where Does It All Go?

The Lifeline of Nations: Understanding the Dynamics of Tax Revenues Tax revenues are more...

Achieve Clarity: Essential Insights for Your Normal Tax Year

The Rhythm of Revenue: Understanding Your Normal Tax Year in Pakistan For every individual, business,...

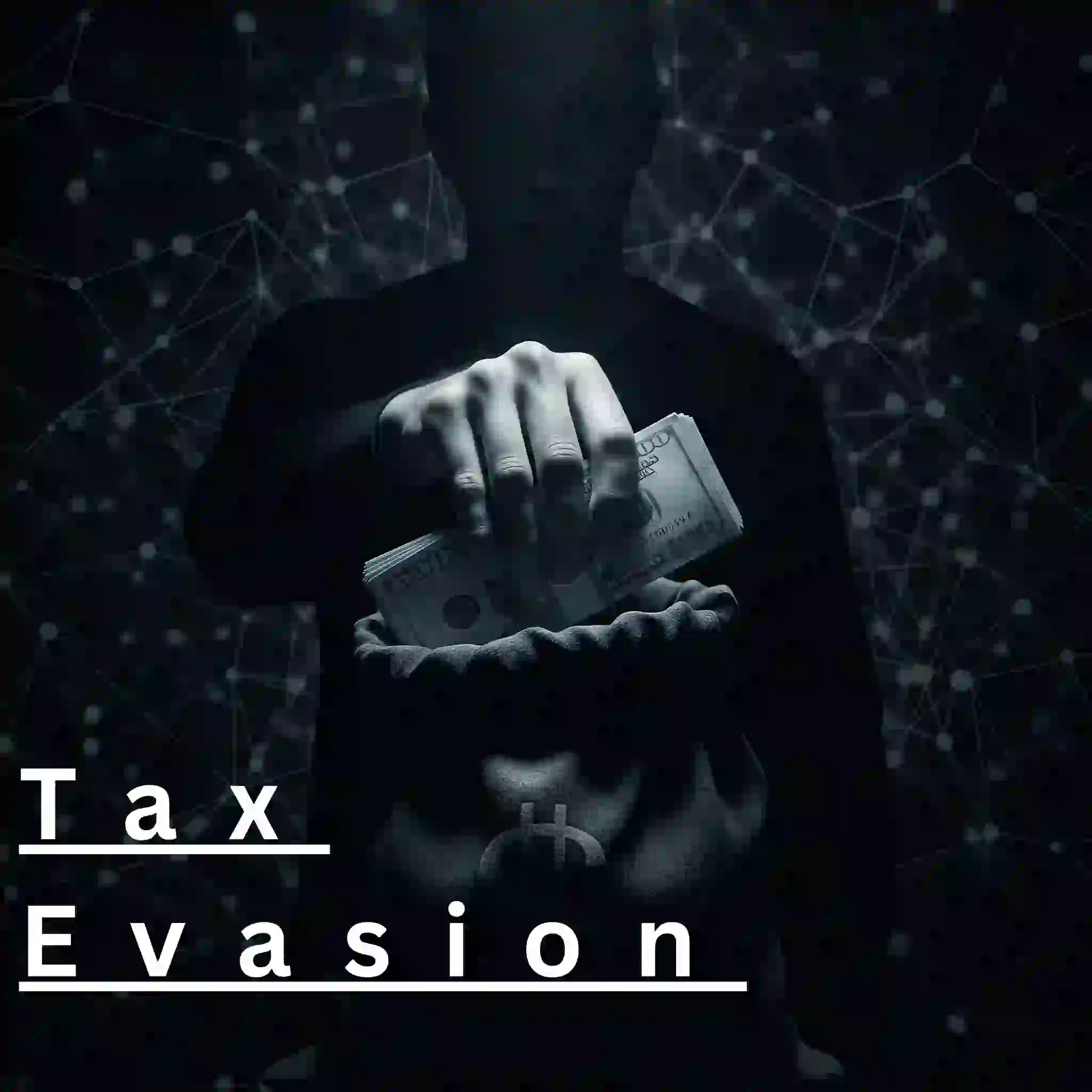

10 Empowering Truths About Tax Evasion Every Pakistani Should Know

Tax Evasion in Pakistan: A Hidden Crisis Undermining the Nation Introduction Tax evasion is a...

Subscribe to Get Newest Updates

We bring you the latest tax updates you do not miss anything.