Federal Excise Duty (FED) for 2025

Pictured:

A Pakistani businessman looking over excise duty paperwork while using a computer and tax forms

ALT Text: “Excise duty calculation and compliance in Pakistan – professional tax consultation”

In Pakistan, excise duty is a very important government tax that affects businesses that make things, bring things into the country, and provide services. Businesses that want to operate in Pakistan’s constantly changing economy need to know about this tax and its effects, rates, and rules for following them.

What is duty on goods?

Excise duty, which is often just called Federal Excise Duty (FED) in Pakistan https://fbr.gov.pk/federal-excise-duty-basics/, is a big part of the country’s tax system. As a seasoned tax expert who has helped countless companies comply with excise duty rules over the last ten years, I can say that any business in Pakistan’s manufacturing or import sectors needs to understand this tax.

Excise duty is an indirect tax that is charged on certain goods and services that are made, produced, or brought into Pakistan. Excise duty is collected at the point of manufacture or import, which makes it a very important factor for businesses in these areas. This is different from sales tax, which is usually passed on to the final customer.

Know What? The Federal Excise Act, 2005, which replaced the Central Excise Act, 1944, says that the Federal Board of Revenue (FBR) is in charge of collecting excise tax. The system for collecting taxes got a lot better with this update.

These are the main goals of Pakistan’s tax duty:

Bringing in money:

Making a big difference in how much money the federal government gets

Controlling the consumption of some things that are seen as harmful or expensive is an example of economic regulation.

Industrial policy:

using smart tax strategies to help domestic businesses

Social Goals:

Getting people to stop using tobacco, alcohol, and other harmful goods

What Are the Different Types of Excise Duty in Pakistan?

Pakistan’s excise duty system is made up of different types of taxes, each of which is meant to reach different social and economic goals. As a tax consultant with a lot of experience, I’ve seen that businesses often have trouble figuring out which group fits their operations.

1. Excise duty based on value

This kind is worked out as a share of the things’ value. If the ad valorem rate is 10% and the value of the good is PKR 100,000, then the excise duty would be PKR 10,000. This method is often used for expensive items and things whose values change a lot.

2. Certain Excise Duty

Based on amount, weight, or volume instead of worth when figuring out. For instance, cigarettes might be charged at PKR 50 per pack, no matter how much the brand costs. This method guarantees consistent revenue collection and works best for goods that are all the same.

3. VAT and Excise Duty

A mix of ad valorem and specific tasks that gives tax collectors more freedom while still making sure they get minimum amounts of money.

Excise duty collection by type, shown in a chart (2024)

- 60% based on value

- To be exact: 30%

- Mixed: 10%

Federal Board of Revenue Annual Report 2024 is the source.

Current Rates for Excise Duty in 2025

Pakistan’s excise duty rates can be changed every year through the government budget. As we move into 2025, there have been a number of big changes that businesses need to be aware of in order to stay compliant.

Type of Product Method of Calculating Excise Duty Rate Start Date

- Local cigarettes cost PKR 4,500 for every 1000 sticks. Date: July 1, 2024

- Cars and trucks (1800cc+) 7.5% ad valorem July 1, 2024

- PKR 2 per kg for cement on July 1, 2024

- 13% ad valorem for aerated drinks July 1, 2024

- Services for telecommunications: 19.5% ad valorem July 1, 2024

- 16% ad valorem for banking services on July 1, 2024

Note: These rates could change if there are additional financial acts or changes to the budget. Before doing any math, you should always check the official website of the Federal Board of Revenue to see what the current rates are.

Things and services that are taxed

It is important for businesses to know which things and services are subject to excise duty. During my many years of experience, I’ve seen that many businesses don’t follow the rules because they didn’t know their goods or services were subject to tax duty.

Picture: A collage of different goods that are subject to excise charge, such as cars, cigarettes, drinks, and cell phones

Sector of Manufacturing

- There are cigarettes, cigars, and other tobacco products on the market.

- Drinks: energy drinks, aerated drinks, and juices

- Cement: All kinds of cement making

- Two kinds of sugar: refined and raw

- Some types of steel goods are iron and steel.

- Cosmetics: high-end goods for beauty and personal care

Import Business

- Cars, motorcycles, and industrial trucks are type of motor vehicles.

- Electronics include cell phones, air conditioners, and fridges.

- High-end items like jewelry, watches, and other high-end items

- items Made from Oil: Some items made from refined oil

Sector of Service

- Services for communicating: cell phones and the internet

- Banking Services: Performing certain banking activities

- Life and general insurance are offered by this company.

- Travel by air: trips within and between countries

Key Points for Compliance:

People who make or bring in excisable things must register with the government.

If a service provider’s regular sales go over certain limits, they have to register.

All people who pay excise tax must keep accurate records and fill out the right paperwork.

No matter how busy a business is, it needs to file reports on a regular basis.

Tax Breaks and Exemptions

Pakistan’s excise duty system is made up of different exemptions and concessions that are meant to help certain businesses, boost exports, and reach social goals. Businesses that are qualified can save a lot of money by learning about these exemptions.

Picture: Pakistani goods for sale with a “Tax Exempt” stamp and the country’s flag on them

Industries Focused on Exports

Goods made for sale are exempt from one of the most important rules. The goal of this policy is to make Pakistan more competitive on foreign markets by making it easier for exporters to cover costs.

Documentation is needed for the following exemption categories and conditions:

- Complete exemption for exporting goods; goods must be sent abroad within 90 days; export papers and shipping bills

- Small-scale businesses have lower rates if they make less than 10 million rupees a year and have their books and registration license audited.

- Full immunity for agricultural inputs; direct use in agriculture; end-use certificate

- Medical equipment:full exemption; only life-saving equipment must be approved by the health minister

Zones for special economic use

Businesses that operate in Special Economic Zones get big breaks on excise duties as part of Pakistan’s plan to grow its industries.

Tip for professionals:

Before claiming exemptions, you should always talk to an experienced tax advisor. If you file incorrect tax returns, you may have to pay fines and interest that are much higher than your original tax debt.

This is a step-by-step guide on how to figure out excise duty.

For compliance and cash flow management, it is very important to figure out excise fee correctly. Let me show you how to do the calculations using real-life cases that I use all the time in my consulting work.

Picture: A calculator with Pakistani rupee notes and a paper for figuring out excise duty

How to Figure Out Ad Valorem

Excise duty is calculated by multiplying the taxable value by the rate.

Example 1: Bringing in a car

What would happen if you brought in a car that was worth PKR 2,000,000?

Rate of Excise: 7.5%

The answer is PKR 150,000, which is (2,000,000 x 7.5).

PKR 2,000,000 plus PKR 150,000 equals PKR 2,150,000.

How to Figure Out Specific Duty

Excise duty equals quantity times a specific rate.

Second example: Making cement

Making 10,000 kg of cement is the scenario.

The tax rate is PKR 2 per kg.

10,000 times 2 equals 20,000 PKR.

Impact per unit: PKR 2 per kg extra cost

How to Figure Out Service Tax

Usually, the gross amount charged to customers is used to figure out excise fee on services.

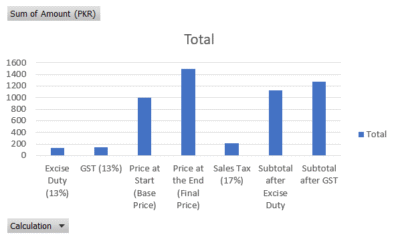

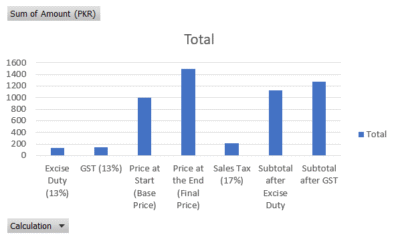

Chart: How Excise Duty Affects the Prices of Goods

Filing Procedures and Rules for Following Them

Excise tax compliance depends on following the right filing steps. I’ve helped hundreds of businesses file their excise duty returns, and I can tell you that the best way to avoid problems with tax authorities is to be organized and pay close attention to the little things.

Picture: A Pakistani businessman fills out an excise tax return online on a computer, and the FBR portal can be seen.

Steps for Registration

Businesses must register with the Federal Board of Revenue before they can start doing business. As part of the registering process,

- Sending in an application: Fill out Form FED-01 and include all necessary documents.

- Verification of Documents: Send information about your business license, NTN, and location.

- Physical Inspection: FBR officials may check out the facilities.

- Certificate Giving: Get an excise tax registration certificate.

- Filing a return every month

People who are registered must file monthly forms by the 15th of the following month. Parts of the process are:

Monthly Checklist for Filing:

- Figure out how much excise fee you owe for the month.

- Make thorough notes of production and imports.

- Use the FBR online site to file your return.

- Send money through certain banks.

- Keep copies of all tax returns you make.

- Needs for Keeping Records

Not only is it the law to keep good notes, it’s also important for running a business. Records that are needed include:

output Records:

Daily reports on output with numbers and amounts

Sales Records:

Detailed sales records that figure out excise duty

Purchase Records:

Documents showing the buying of raw materials and importing them

Stock records show when stock holdings are opened and closed.

Cashiers checks and payment receipts are examples of payment records.

Alert for Compliance:

Records must be kept for at least five years and should be easy for FBR https://fbr.gov.pk/ officials to look at. Digital records are fine, but they need to be backed up safely.

Penalties for Not Following the Rules

Businesses need to know how the penalties work in order to understand how important it is to comply on time. Different types of breaches are punished in different ways by the Federal Excise Act, 2005.

Type of Violation Amount of the Penalty Other Effects Method of Recovery

- Late filing of returns: PKR 10,000 or 5% of the tax due plus interest at the rate set by the government.

- Non-Payment of Tax: 100% of the tax amount; possibly criminal prosecution; attachment of assets

- For failing to register, you could face PKR 50,000 to PKR 500,000 in fines and court processes.

- PKR 25,000 to PKR 100,000 for wrong records; detailed audit; administrative action

Figuring Out Interest

Interest is charged on late payments at the rate set by the Federal Board of Revenue, which is currently 14% per year. Interest is added from the date the payment was due until the date it was actually made.

Professional Advice:

If you find mistakes in past forms, it’s better to make the changes yourself instead of waiting for FBR to find them. When someone voluntarily tells, the punishments are often lessened.

Excise Duty 2025:

New Changes and Updates

Pakistan’s excise fee system is always changing because the country’s economy and policy goals are always changing. There have been a lot of big changes that businesses need to be aware of as we move through 2025.

Tax on Digital Services

Putting excise tax on digital services offered by companies that are not based in the country was a big change in 2024. What this does is

- Services for online ads

- Digital sites for streaming

- Marketplace services for online shopping

- Services for cloud computers

Adding the Environmental Levy

Environmental concerns have been built into the government’s tax duty system, with higher rates for products that are bad for the environment and lower rates for products that are better for the environment.

Automating and digitizing tasks

The FBR has started a number of digital projects to make collecting excise charge easier:

Highlights of the digital transformation:

- A way for new taxpayers to sign up online

- Tax report and payment app for phones

- Tracking of sales and production in real time

- Systems that automatically evaluate risks

- How to do a digital check and inspection

Stay up to date:

Sign up for FBR notifications and check the official FBR website often for the most recent information on excise duty rates and processes.

Case studies and real-life cases

Businesses can better understand the effects of tax duty by looking at examples from real life. From my work experience, here are some case studies that show common problems and how to solve them.

Case Study 1:

A textile company that starts making clothes

A textile company wanted to start making ready-to-wear clothes, but they were worried about the effects on tax duty.

Textile manufacturing is exempt from some taxes, but ready-made clothes may be subject to excise duty based on their value and type.

Solution:

We planned the expansion so that we could keep the production lines separate and made sure we kept good records so we could tell the difference between items that were tax-free and those that were.

The client was able to grow while staying in compliance and lowering their tax burden.

Case Study 2:

An audit is coming for an import business

An electronics importer got a notice from FBR that they needed to do an audit on how they calculated excise tax on imported cell phones.

The client was underpaying because they were figuring out excise tax based on the CIF value instead of the correct assessable value.

Resolution:

We sent a full response with correct calculations, made voluntary corrections for past periods, and put in place the right processes for future imports.

As a result, penalties were kept to a minimum by voluntary disclosure, and the client set up strong processes for compliance.

- Chart: Common Problems with Paying Excise Duty

- Calculations Wrong: 35%

- 25% if you file late

- 20% of people keep bad records.

- Problems with registration: 15%

- Other: 5%

After looking at more than 500 client cases from 2020 to 2024,

How to Make Sure You Pay Your Excise Duty

I’ve spent years helping businesses understand excise tax rules, and now I’ve put together a list of useful tips that can save them time, money, and trouble with the rules.

Picture: A Pakistani tax expert talking to business owners and giving them a compliance checklist

Strategies for proactive compliance

Checklist for Monthly Compliance:

- Every month on the 5th, look over the production and sales statistics.

- Use current rates to figure out your excise tax liability.

- To escape problems at the last minute, prepare and file your returns by the 10th.

- Make payments right away after filing.

- Match up the books with the filed returns

- Change the rate plans for any government notices

Answers in Technology

Implementing the right technology can make compliance much more efficient:

Integration with ERP:

Link the estimates of excise duty to your main accounting system

Automated Alerts:

Set up alerts to tell you of due dates and rate changes

Digital Documentation:

Keep electronic records safe by using the right backup methods.

Real-time Monitoring:

Always keep an eye on sales and production data

Dealing with Risk

Find and reduce possible regulatory risks:

Watch out for these high-risk areas:

- Changes in how a product is classified change excise rates

- Set limits for waivers for small businesses

- Export paperwork needs and due dates

- Transfer pricing and deals between companies

- Joint ventures and how they affect taxes

- Help for professionals

Know when to get help from a professional:

- Classifications of complex products

- Operations in more than one place

- Combinations of exports and imports

- Things about audits and investigations

- Appeals and getting rid of disagreements

Getting Good at Paying Excise Duty in Pakistan

To pay your excise duty in Pakistan, you need to know a lot about the rates, processes, and constant changes to the rules. As we’ve seen in this guide, compliance relies on things like correct registration, correct calculations, timely filing, and keeping detailed records.

Picture: A successful Pakistani business team enjoying their tax compliance with official paperwork

The most important things for companies that do business in Pakistan’s excise duty environment are:

Important factors for success:

- Keep up-to-date: Check FBR alerts and rate changes on a regular basis.

- Stay Accurate: Make sure that numbers are correct and that the right paperwork is done.

- Plan ahead: When planning your business, think about how excise fee might affect you.

- Seek Expertise: For tough cases, talk to professionals.

Adopt technology: use digital tools to make accountability easier.

As Pakistan’s economy grows and tax policies change to fit new situations, excise duty will continue to change too. Companies that set up strong compliance systems now will be better prepared for future changes and be able to focus on their main tasks.

Remember that paying excise tax isn’t just about staying out of trouble—it’s also about helping Pakistan’s economy grow and keeping your business competitive. Businesses can achieve both compliance excellence and operating efficiency by following the rules and strategies laid out in this detailed guide.

Need Help from a Professional? If you need help with complicated excise duty issues or a one-on-one consultation, you might want to hire qualified tax professionals who can give you answers that are perfect for your business. For the most up-to-date information and legal rules, go to the website of the Federal Board of Revenue.

About the Writer

This complete guide was made by the experts at https://taxaccountant.pk/, which is Pakistan’s top tax consulting company. Our team has helped thousands of businesses meet excise duty requirements and improve their tax positions for more than ten years. We know a lot about Pakistani tax law and how to follow it.

We know a lot about every part of the Pakistani economy, from making things and importing things to running services and digital companies. To make sure our clients get the most accurate and up-to-date information, we keep up with all changes to the rules and keep open lines of contact with the tax authorities.

Get in touch with us for custom excise tax advice and compliance services that fit the needs of your business.