Decoding the Active Taxpayer List (ATL) in Pakistan: Your Guide to Tax Compliance

In Pakistan’s dynamic economic landscape, understanding tax obligations and maintaining an “Active Taxpayer” status is paramount for individuals and businesses alike. The Federal Board of Revenue (FBR) meticulously maintains the Active Taxpayer List, a crucial database that distinguishes compliant taxpayers from non-filers. Being on the ATL isn’t just about adhering to the law; it unlocks a host of benefits and shields you from significant penalties.

What is the Active Taxpayer List (ATL)?

The Active Taxpayer List is a comprehensive record of individuals and entities who have filed their annual income tax returns with the FBR for the previous tax year. Essentially, it’s the FBR’s way of recognizing and rewarding tax compliance. The ATL is updated regularly, often daily, to reflect timely return submissions. This means that if you file your income tax return by the due date (or within any extended period), your name will appear on the ATL, immediately granting you the associated advantages.

Why is Being on the ATL So Important? The Benefits of Active Taxpayer Status

The advantages of being an active taxpayer in Pakistan are substantial and directly impact your financial dealings and legal standing:

-

Reduced Withholding Taxes: This is perhaps the most significant benefit. Active taxpayers enjoy significantly lower withholding tax rates on various transactions, including:

- Bank withdrawals and transactions

- Property purchases and sales

- Vehicle registration and transfers

- Electricity bills and other utilities

- Dividends and other investment income

- Professional services

For non-filers, these withholding tax rates are often doubled, leading to considerable financial disadvantages.

-

Access to Financial Services: Being on the ATL makes it easier to access formal financial services. Banks are often more willing to grant loans, financing, and instalment plans to active taxpayers, as it indicates financial responsibility and compliance. Non-filers may face restrictions or outright denial for such services.

-

Legal Compliance and Avoidance of Penalties: This is the foundational aspect. Filing your tax return and being on the ATL ensures you are compliant with Pakistani tax laws. Failure to do so can lead to:

- Civil Penalties: Fines for late filing, non-payment of tax, and under-reporting of income. These penalties can be substantial and accumulate daily.

- Criminal Penalties: For intentional and severe violations, criminal penalties can include imprisonment, hefty fines, and even asset forfeiture.

- Loss of ATL Status: If you miss the filing deadline, your name will be removed from the ATL, leading to the application of higher tax rates and other disadvantages. To regain ATL status, you generally need to file your return and pay a surcharge.

-

Tax Refunds and Adjustments: Active taxpayers are eligible to claim refunds for any overpaid taxes. The process of claiming refunds is smoother and more straightforward for those on the ATL.

-

Business Opportunities: Many government bodies, public sector organizations, and even private companies prefer to engage with compliant taxpayers. Being on the ATL can open doors to business contracts, tenders, and partnerships that might be inaccessible to non-filers.

-

Property and Vehicle Transactions: As mentioned, active taxpayers face lower taxes on buying and selling property and registering/transferring vehicles. For non-filers, these transactions become more expensive and, in some cases, restricted.

Consequences of Not Being on the ATL

The flip side of the ATL benefits is the significant disadvantages faced by non-filers:

- Higher Withholding Taxes: As detailed above, non-filers bear a much heavier tax burden on various transactions, essentially paying a penalty for non-compliance with every financial activity.

- Restricted Access to Financial Services: Obtaining loans, credit cards, or other financial products becomes exceedingly difficult.

- Penalties and Fines: The FBR imposes strict penalties for late or non-filing of tax returns, which can quickly add up. For individuals, a surcharge of PKR 1,000 is typically levied to regain ATL status after late filing, while for Associations of Persons (AOPs) it’s PKR 10,000, and for companies, it’s PKR 20,000.

- Legal Scrutiny: Non-compliance can lead to increased scrutiny from the FBR, potential audits, and legal action.

- Difficulty in Business Operations: Businesses that are not on the ATL may find it challenging to conduct transactions, open corporate bank accounts, and participate in formal economic activities.

How to Become and Remain an Active Taxpayer

Becoming an active taxpayer in Pakistan is a straightforward process, primarily involving online registration and timely filing:

Obtain a National Tax Number (NTN) https://iris.fbr.gov.pk/#verifications: If you don’t already have one, this is the first step. Individuals can apply online through the FBR’s Iris portal using their CNIC

Register on the FBR IRIS Portal: This online portal is your gateway to all tax-related activities, including filing returns.

File Your Annual Income Tax Return: This is the most crucial step. You need to declare your income, assets, and liabilities for the relevant tax year. The FBR provides user-friendly forms on the Iris portal.

Pay Due Taxes (if applicable): If your income exceeds the taxable threshold, ensure you pay the calculated tax liability by the due date.

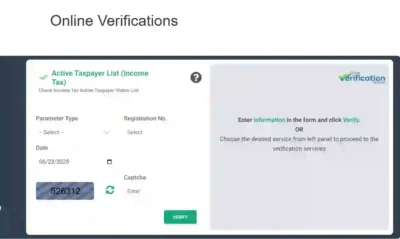

Monitor Your ATL Status: The FBR allows you to check your ATL status easily online or via SMS.

-

- Online: Visit the FBR website (fbr.gov.pk), navigate to the “Active Taxpayers List” section, and enter your CNIC (for individuals) or NTN (for businesses).

- SMS: Type “ATL [space] 13-digit CNIC” (for individuals) or “ATL [space] NTN” (for businesses) and send it to 9966.

To remain on the ATL, consistent and timely filing of your annual income tax return is essential. The ATL is updated annually, and your status for the current ATL (e.g., ATL 2025) is based on your filing for the previous tax year (e.g., Tax Year 2024).

Conclusion

In conclusion, being an active taxpayer in Pakistan is not merely a bureaucratic formality; it’s a strategic decision that offers tangible financial advantages and ensures legal compliance. The FBR’s Active Taxpayer List serves as a clear indicator of tax responsibility, rewarding those who contribute to the national exchequer with reduced tax burdens and smoother financial operations. For individuals and businesses alike, understanding the ATL and proactively fulfilling tax obligations is key to navigating Pakistan’s economic landscape successfully. Don’t be a non-filer; embrace your role as an active taxpayer and reap the benefits.

For such services, you can always approach us at https://taxaccountant.pk/