I Got a Notice of 147 (Intimation to Pay Advance Tax): What to Do?

Dear Taxpayer,

It is intimated that you are liable to pay advance tax u/s 147 of the Income Tax Ordinance, 2001 for this quarter. The liability of advance tax for the quarter is shown in the table at the end.

2. Please note that this is minimum estimated advance tax liability for the quarter. However, if your advance tax liability is more than given in the table, you are bound by law to pay actual liability for the quarter.

3. You are requested to pay your advance tax before the statutory date as provided in section 147 without fail. In case of difference in your advance tax liability for the quarter, you may intimate this office duly supported by documentary evidence, on or before the due date through your online Iris account (https://iris.fbr.gov.pk/public/txplogin.xhtml). Please note that non-payment of advance tax may invoke penalty and default surcharge provisions of Income Tax Ordinance, 2001.

4. We look forward to your cooperation for promoting tax compliant culture in Pakistan

Got a Notice of 147 (Intimation to Pay Advance Tax)

Receiving a Section 147 notice from the Federal Board of Revenue (FBR) in Pakistan can be intimidating, especially if you’re unsure about what it means or how to respond.

In this blog post guide will walk you through everything you need to know about the 147 notice (Intimation to Pay Advance Tax), why you received it, what steps to take, and how to stay compliant—ensuring peace of mind and avoiding penalties.

What Is a Section 147 Notice?

A Section 147 notice is an official intimation from the FBR requiring you to pay advance tax for a specific quarter under the Income Tax Ordinance, 2001. Advance tax is a provisional payment towards your annual tax liability, collected in installments throughout the year to ensure timely revenue for the government345.

In simple terms: The FBR expects you to pay a portion of your expected annual tax in advance, based on your previous year’s tax or estimated current year’s income.

Who Receives a Section 147 Notice?

You may receive a Section 147 notice if you fall into one of the following categories:

-

Individuals with significant or regular taxable income (usually above a certain threshold)

-

Business Owners (sole proprietors, partnerships/AOPs)

-

Companies and Corporations

-

Taxpayers with a history of substantial tax payments in previous years

The FBR uses your previous tax records and current financial data to determine if you should be making advance tax payments45.

Why Did You Get This Notice?

The main reasons for receiving a Section 147 notice include:

-

Regular or high income: You consistently earn above the taxable threshold.

-

Business or company ownership: Businesses and companies are generally required to pay advance tax.

-

Your past tax payments: The FBR expects you to owe a significant amount based on your history.

-

Ensuring timely tax collection: The government wants to collect tax revenue throughout the year, not just at year-end4.

Understanding the Notice: What Does It Contain?

A typical Section 147 notice includes:

-

The amount of advance tax due for the quarter

-

Deadlines for payment (usually quarterly: 25th September, 25th December, 25th March, and 15th June)

-

Instructions for payment and what to do if you disagree with the calculated amount

-

A warning about penalties and default surcharges for non-compliance

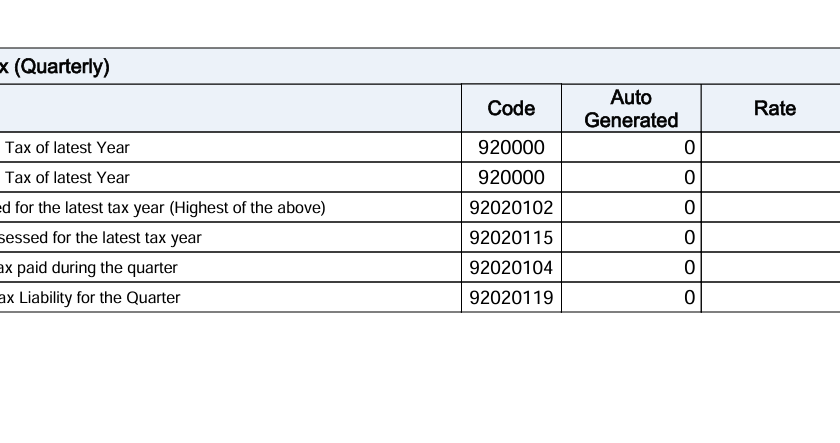

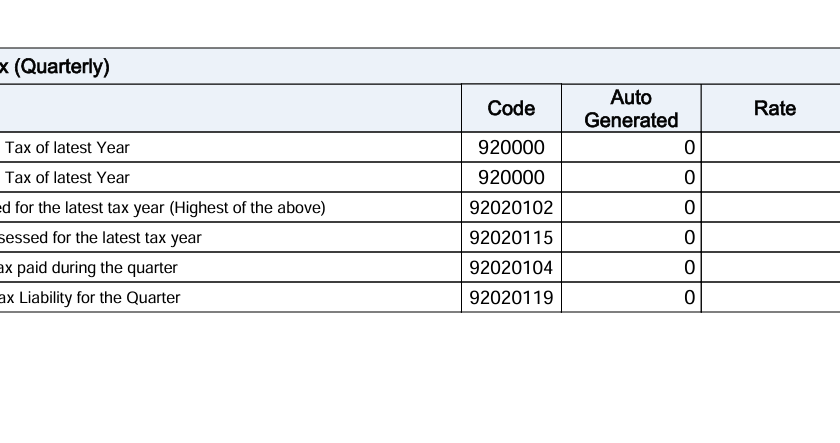

Sample Table from a Notice:

| Description |

Declared (PKR) |

| Normal Income Tax of latest Year |

125,800 |

| Tax assessed for the latest tax year |

125,800 |

| 1/4th of Tax assessed for the latest tax year |

31,450 |

| Adjustable tax paid during the quarter |

0 |

| Net Advance Tax Liability for the Quarter |

31,450 |

How Is Advance Tax Calculated?

For Individuals:

Advance Tax=(Tax Assessed for Latest Year4)−Tax Paid in the QuarterAdvance Tax=(4Tax Assessed for Latest Year)−Tax Paid in the Quarter

For AOPs and Companies:

Advance Tax=(A×BC)−DAdvance Tax=(CA×B)−D

Where:

-

A: Turnover for the quarter

-

B: Tax assessed for the latest tax year

-

C: Turnover for the latest tax year

-

D: Tax paid in the quarter for which tax credit is allowed under Section 16845

Note: If the minimum tax (Section 113) for the quarter is higher than the above calculation, you must pay the minimum tax as advance tax5.

Step-by-Step: What to Do After Receiving a Section 147 Notice

1. Review the Notice Carefully

-

Check the amount due

-

Note the payment deadline

-

Read any specific instructions

2. Calculate Your Advance Tax Liability

-

Use the formulas above to verify the FBR’s calculation.

-

If your actual liability is higher than the notice, you must pay the higher amount by law.

-

If you believe your liability is lower, prepare supporting documents.

3. Prepare for Payment

-

Ensure you have sufficient funds.

-

Mark the payment deadline in your calendar.

4. Make the Payment

-

Use the FBR’s online IRIS portal (https://iris.fbr.gov.pk/public/txplogin.xhtml) for payment.

-

Pay before the due date to avoid penalties.

-

Save the payment receipt for your records4.

5. File an Estimate (If Your Tax Liability Differs)

-

If your income or circumstances have changed, file an updated estimate via IRIS.

-

Attach documentary evidence (bank statements, invoices, etc.).

-

Submit before the due date.

6. Respond Promptly

-

Always act within the deadlines specified in the notice.

-

Non-compliance can result in penalties and default surcharge6.

7. Seek Professional Help if Needed

-

Consult a tax advisor if you’re unsure about calculations or procedures.

-

Professionals can help you avoid errors and ensure compliance4.

8. Keep Detailed Records

-

Maintain copies of the notice, payment receipts, calculations, and correspondence.

-

These are essential for future tax filings and audits.

Penalties and Default Surcharge for Non-Payment

If you fail to pay the advance tax by the due date, or pay less than 90% of your actual liability for the year, you are liable to pay a default surcharge at 12% per annum on the shortfall amount56.

| Scenario |

Consequence |

| Late payment of advance tax |

12% per annum default surcharge |

| Paid less than 90% of actual tax due |

12% per annum surcharge on shortfall |

| Continued non-compliance |

Further penalties, legal action |

How to Appeal If You Disagree with the Assessment

If you believe the advance tax assessed is incorrect:

-

File a written notice of appeal with the Commissioner of Income Tax (CIT) within 30 days of the assessment date.

-

State the grounds for appeal and attach supporting documentation.

-

If the CIT upholds the assessment, you may further appeal to the Appellate Tribunal7.

Frequently Asked Questions (FAQs)

Q: Can I ignore the Section 147 notice if I have already paid enough tax?

A: No. You must respond and, if necessary, submit evidence through IRIS. Ignoring the notice can result in penalties45.

Q: What if my income has decreased this year?

A: File an updated estimate with evidence via IRIS before the due date to adjust your advance tax liability4.

Q: How do I pay advance tax?

A: Log in to your IRIS account, generate a payment challan, and pay via authorized banks or online channels4.

Q: What happens if I miss the deadline?

A: You will be charged a default surcharge and may face further penalties6.

Advance Tax Payment Calendar (Typical Deadlines)

| Quarter |

Due Date |

| 1st Quarter |

25th September |

| 2nd Quarter |

25th December |

| 3rd Quarter |

25th March |

| 4th Quarter |

15th June |

Always check your notice for specific dates.

Tips for Managing Advance Tax Notices

-

Stay organized: Keep all tax documents and notices in one place.

-

Set reminders: Mark payment deadlines in your calendar.

-

Consult professionals: When in doubt, seek expert advice.

-

Use the IRIS portal: For payments, estimates, and correspondence.

-

Act quickly: Delays can be costly.

Conclusion: Take Action, Stay Compliant

Receiving a Section 147 notice is a standard part of the tax process for many Pakistani taxpayers. By understanding your obligations, accurately calculating your liability, and meeting deadlines, you can avoid penalties and maintain a clean tax record. If you’re ever unsure, professional help is readily available.