Professional Tax in Pakistan for Businesses and Professionals in 2025

When it comes to Pakistan’s tax system, professional tax is one of the most important and often ignored parts. Businesses and professionals have to deal with a lot of complicated tax rules. Knowing the professional tax rules is important to stay out of trouble and keep things running smoothly. With recent changes to tax laws and more regulation by provincial authorities, it’s more important than ever to know what your professional tax obligations are.

What is Professional Tax?

In Pakistan, the regional governments directly tax people who work in professions, trades, callings, or jobs in their own areas. This is called professional tax. The Federal Board of Revenue (FBR) https://fbr.gov.pk/ is in charge of federal taxes, but the provincial government is in charge of professional taxes. This is how the law divides power between the federal and provincial governments.

The goal of this tax system was to bring in money for provincial governments while also making sure that all working people helped their provinces grow. The tax affects many types of professionals, such as doctors, lawyers, engineers, experts, business owners, and workers in many different fields.

Important Things About Professional Tax

Provincial Jurisdiction:

Different parts of Pakistan have different professional tax rates, exemption limits, and collection methods because each province sets its own rules.

Professional tax is a type of direct tax that people and businesses have to pay based on their professional duties, income, or business turnover.

Annual Assessment:

Professional tax is usually collected once a year in most provinces, but payment schedules can be anything from monthly to quarterly, based on the rules in each province.

Wide Range of Activities:

The tax affects almost all professional activities, from old-fashioned jobs like medicine and law to newer ones like IT and digital marketing.

Authority and the legal structure

When it comes to Pakistan, professional tax is allowed because the country’s constitution lets provinces charge taxes on jobs, callings, professions, and trades.

Basis in the Constitution

The Constitution of Pakistan clearly divides the power to tax between the federal and regional governments in the Federal Legislative List and the regional Legislative List. Professional tax is completely within the control of the provinces, so each one can make its own laws and decide how to enforce them.

In each province, the main laws that control professional tax are called Provincial Professional Tax Acts. The taxation areas, rates, exemptions, and administrative processes that are unique to each province are set out in these acts.

Structure of Administration

The main administration body in charge of professional tax collection and enforcement is the Provincial Revenue Department. These departments work with district-level offices to make sure they cover all areas, both in cities and in the country.

In most provinces, the Excise and Taxation Departments are in charge of professional tax management. This includes things like registration, assessment, collection, and enforcement.

The Federal Board of Revenue is not directly in charge of tax administration, but it works with provincial governments to make sure that general tax policy is consistent and that people are not taxed twice.

Who Has to Pay the Professional Tax?

In Pakistan, many people and businesses that work as professionals within the borders of a province are required to pay professional taxes.

Professionals Working Alone

Licensed Professionals:

Licensed professionals like doctors, lawyers, engineers, architects, trained accountants, and others usually have to pay professional tax, even if they don’t have a job.

Business Owners:

Whether their business is listed or not, business owners are subject to professional tax obligations based on the activities they carry out and the amount of money they make.

Consultants and Freelancers:

Independent consultants, freelancers, and service providers must pay professional tax depending on how much money they make and how many clients they have.

Employees:

People who get paid a salary in the public or private sector may have to pay professional tax, which is usually taken out by their bosses when they process their payroll.

Entities in Business

Private Companies:

Professional tax is due on corporations and private limited companies based on the type of business they run, the number of employees they have, and their annual income.

Business partnerships and limited liability partnerships must pay professional tax based on the total amount of money they make and the work they do.

Individual business owners who run their own businesses as sole proprietors have to pay professional tax on the money they make and the things they do for their businesses.

Based on your idea, here is a template for a table outlining professional tax liability by category.

This table structure is designed to provide a clear and organized overview of professional tax obligations for different types of income earners and businesses. The values included are for illustrative purposes only

Category of Person/Profession

|

Annual Income/Turnover Slab (PKR)

|

Professional Tax Payable (PKR Per Annum)

|

Basis of Tax

|

|

Salaried Individuals

|

Up to PKR 600,000 |

Nil |

Fixed Amount |

Tax may be deducted at source by the employer. |

|

PKR 600,001 – 1,200,000 |

1,000 |

Fixed Amount |

|

|

Above PKR 1,200,000 |

2,000 |

Fixed Amount |

|

Self-Employed Professionals

|

Up to PKR 2,000,000 |

5,000 |

Fixed Amount |

Includes professions like doctors, lawyers, chartered accountants, engineers, etc. |

|

Above PKR 2,000,000 |

10,000 |

Fixed Amount |

|

Business/Firm Owners

|

Annual Turnover Up to PKR 5,000,000 |

5,000 |

Fixed Amount |

Tax is generally based on the business’s total annual turnover. |

|

Annual Turnover Above PKR 5,000,000 |

10,000 |

Fixed Amount |

|

|

|

All Categories |

2,000 |

Fixed Amount |

Tax may be paid as a lump sum or deducted at source. |

Other Categories

|

Varies by specific role |

Varies |

Varies |

May include agents, brokers, or individuals in specific trades not covered in standard categories. |

Rate Range for Professional Category Tax Basis

- Medical Professionals Make Between PKR 2,000 and PKR 15,000 a Year

- Legal professionals make between PKR 1,500 and PKR 12,000.

- Engineers who work on projects make between PKR 2,500 and 20,000.

- PKR 3,000 to 25,000 for business owners who hire and fire employees.

- Service income for IT professionals between PKR 1,000 and 10,00

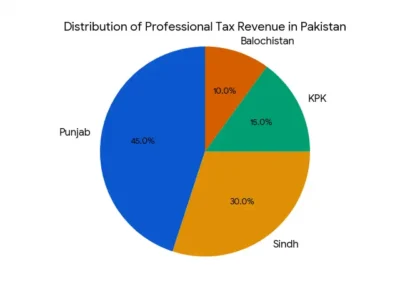

Provincial Differences in the Professional Tax

Because Pakistan is a federal system, professional taxes are applied in very different ways in each province. This is because each province’s system is based on its own economic factors and administrative strengths.

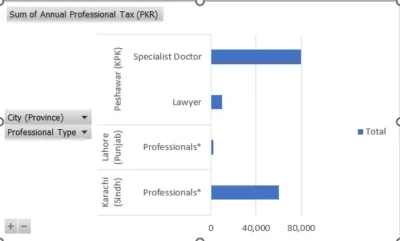

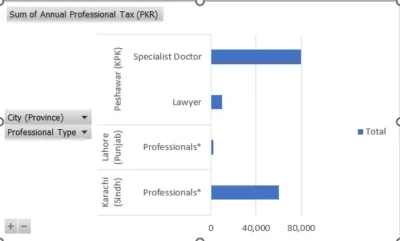

Punjab Province Business Tax

Punjab is Pakistan’s most populous and economically active region. As a result, it has created a thorough professional tax system that includes Lahore, Faisalabad, Rawalpindi, and Multan, as well as other cities.

Important parts of Punjab’s system are:

- Income-based tax brackets for workers who work alone

- Evaluation of businesses based on turnover

- Registering and paying online is possible.

- Payment plans every three months for bigger users

- Special rules for people who work in agriculture

- Tax Structure: Punjab has a progressive tax structure, which means that rates go up as income goes up. This makes people more likely to pay their taxes and makes sure that higher earners give more to the province’s revenue.

Implementation in Sindh Province

Sindh province, especially the cities of Karachi and Hyderabad, has put in place a business-friendly professional tax system that takes into account how important the province is for business.

Important Factors:

- Simplified the process of registering new businesses

- tax rates that are specific to each industry

- Integration with other local taxes to make paying them easier

- Exemptions in special economic zones for businesses that focus on exports

Khyber Pakhtunkhwa (KPK) Method

KPK’s professional tax system is fair because it takes into account the province’s varied economic environment, from cities like Peshawar to tribal areas with traditional ways of making a living.

Unique Characteristics:

- Lower tax rates will help businesses grow.

- Payment plans that are flexible for holiday businesses

- Extra care should be taken with border trade tasks

- Procedures made easier for small-scale workers

- The Flexible Framework for Balochistan

Balochistan has its own unique economic and geographical problems, so the province has made its professional tax system very open so that it can work with a wide range of businesses, from mining to farming.

Tax Rates and Ways to Figure Them Out

Pakistan’s professional tax rates are very different between areas and types of professionals. This is because each area’s economy is different and the government needs to raise money.

Method for Figuring Out Based on Income

Most provinces use income-based ways to figure out how much tax a professional should pay, so the more money the professional makes, the more tax they have to pay.

Example of a Progressive Rate Structure (Punjab):

- Income up to PKR 300,000: Not taxed

- PKR 1,200 a year if you make between PKR 300,001 and 500,000.

- Between PKR 500,001 and PKR 1,000,000: PKR 2,400 per year

- PKR 4,800 a year if you make between PKR 1,000,001 and PKR 2,000,000

- PKR 7,200 a year if you make more than PKR 2,000,000

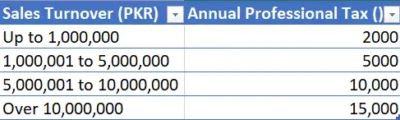

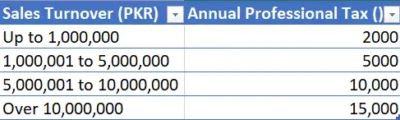

Assessment Based on Turnover

Many provinces use turnover-based assessment methods for businesses and commercial places, which look at the yearly revenue of the business.

Slabs for business turnover:

- Up to PKR 1,000,000 in sales: PKR 2,000 per year

- PKR 5,000 per year for turnovers between PKR 1,000,000 and 5,000,000

- PKR 5,000,001 to 10,000,000 in sales: PKR 10,000 per year

- Over PKR 10,000,000 in sales: PKR 15,000 per year

Some provinces base a business’s professional tax on the number of workers it has. This helps businesses hire more people while also bringing in money.

Strength-based rates for employees:

- PKR 3,000 per year for 1 to 10 people

- PKR 6,000 per year for 11 to 25 people

- PKR 12,000 a year for 26 to 50 people

- PKR 20,000 per year for every 50 workers or more

Rates for Different Sectors

Some provinces have put in place sector-specific professional tax rates that take into account how different businesses work and how much money they can make.

How to Register and What You Need to Do

In Pakistan, there are specific steps you need to take to register for professional taxes. These steps change by province but are usually the same.

What You Need to Do to Register

Individual Professionals need to offer:

- Copy of National Identity Card (CNIC)

- A professional license or a proof of qualification

- Report of income or income tax return

- Information on how to pay taxes by bank account

- Proof of business address records

Things that businesses need are:

- Certificates for registering a business

- Partnership papers or articles of incorporation

- From FBR, get a National Tax Number (NTN).

- List of employees and information on pay

- Verification of business grounds

- A professional filling out tax forms at a government building is a good image to use.

How to Sign Up Online, Step by Step:

- Visit the page for the provincial revenue department.

- Make an account by giving a real email address and phone number.

- Fill out the form for professional tax registration

- Upload the needed files in the forms listed.

- Send in your application and get a confirmation message

- Wait for tax authorities to check and approve the plan.

- Get a proof of professional tax registration

Process of Checking Document

The provincial government carefully checks all the papers that are sent in to make sure they are correct and stop people from avoiding paying taxes.

Steps for Verification:

- Checks for document validity

- Inspection of the business property (if needed)

- Checking other government files against this one

- Verification of professional qualifications

- Verification of income source

How to Pay and When to Pay It

Pakistan’s professional tax payment procedures have been updated to give taxpayers more convenient choices and make sure that taxes are collected on time.

Methods of Payment

Most governments let professionals pay their taxes through online banking, which is convenient for taxpayers because they can do it whenever they want.

You can still make traditional bank branch payments at collection banks in every state.

More recent mobile banking apps can now handle professional tax payments, which makes it easier for tech-savvy workers to follow the rules.

The websites of provincial tax departments let you make direct payments and get a receipt right away.

When payments are due

Payment Once a Year:

Most professionals who work alone pay professional tax once a year, usually by June 30th of each tax year.

Payments every three months:

To make managing cash flow easier, larger businesses and workers with high incomes may have to make payments every three months.

Monthly Withdrawals:

Professional tax is usually taken out of employees’ paychecks every month and sent to the local government by their employers.

How to Handle Late Payments

Grace Periods:

Most provinces give late payments some extra time to catch up. These extra days can be anywhere from 15 to 60 days, based on the province’s rules.

Calculating the Penalty:

Most of the time, late payment fines are worked out by adding up a percentage of the amount of tax still owed every month.

Options for payments over time:

Some governments offer payment plans over time for taxpayers who are having trouble with money.

Certain exceptions and breaks

Pakistan’s areas offer different exemptions and breaks on professional taxes to help certain industries and boost the economy.

Exemptions Based on Income

Minimum Income Limits: Most provinces don’t tax workers who make less than certain minimum amounts each year, which are usually between PKR 200,000 and PKR 400,000.

Agricultural Income:

In most areas, income from farming is not subject to professional taxation.

Pension Income:

Retired professionals who get pension income usually don’t have to pay professional taxes.

Sector-Specific Tax Breaks

Industries that export:

Companies that export goods and services often get big tax breaks to help them earn more foreign currency.

Information Technology:

To encourage growth in the technology industry, professional tax rates are often lowered for IT companies and software houses.

Small and Medium-Sized Businesses (SMEs):

To encourage people to start their own businesses and create jobs, SMEs are given special rates.

Exemptions for certain areas

Special Economic Zones:

Businesses that operate in certain special economic zones may not have to pay any professional taxes at all or only a small amount.

Tribal places:

Some tribal and remote places may have special exemption rules because of the way the economy works there.

Disaster-Affected Areas:

Areas that have been hit by natural disasters or economic problems are often given temporary waivers.

New Ways to Encourage Business

Startup breaks:

To encourage people to start their own businesses, new ones may get professional tax breaks for the first few years.

Women Business Owners:

Some provinces have special rules for businesses owned and run by women.

Youth Initiatives:

To encourage young people to get jobs, young entrepreneurs may gain from lower professional tax rates.

Professionals who don’t pay their taxes can face harsh punishments in Pakistan, which can have a big effect on both companies and individuals.

Fees for late payments

Standard Penalty Rates:

Any unpaid professional tax amounts are fined between 2% and 5% per month in most states.

Compound Interest:

Penalties usually add up every month, making it more expensive to not follow the rules when they’re due.

Minimum Fine Amounts:

Some states set minimum fine amounts that are the same no matter how much tax is still owed. This is done to discourage people from doing wrong.

Penalties for Not Registering

Detection Penalties:

Professionals who work without the right paperwork are usually fined two to three times their yearly tax bill.

Retrospective Assessment:

The government can charge fines and interest on back-dated professional tax returns.

Threats to Close a Business:

If you don’t follow the rules, you could be told to close your business or have your license taken away.

Ways to enforce the law

Attachment of Assets:

To get back taxes, provincial governments can attach bank accounts, homes, and other assets.

Legal Actions:

Serious cases of not following the rules could lead to legal actions and court orders to get back taxes.

Effects on Credit scores:

Not following the rules can hurt your credit scores and make it harder to get banking services.

How to File an Appeal and Get a Decision

Administrative Appeals:

Filing an appeal against a tax penalty assessment can be done through certain administrative routes.

Hearings in a Tribunal:

Appeals at a higher level may be heard by specialized tax courts where the people appealing have lawyers.

Settlement Options:

Some governments have settlement plans that let people who voluntarily follow the rules pay less in fines.

New Changes and Additions for 2024–2025 {#new-changes}

In Pakistan, professional taxes have changed a lot in the past few years. This is because of the government’s larger efforts to digitize government services and bring in more money.

Initiatives for digital transformation

Online Platforms:

All of Canada’s big provinces have made full online platforms for professionals to register, pay, and keep track of their tax obligations.

Mobile Applications:

Taxpayers can now easily get professional tax help and information through dedicated mobile apps.

Digital Receipts:

Today, electronic receipt systems are used instead of paper receipts, which makes things run more smoothly and cuts down on scams.

Rate changes and policy changes

Changes for Inflation:

To reflect rising prices and costs of living, most governments have made changes to professional tax rates.

Simplified Structures:

Several states have made it easier to follow the tax rules by simplifying their tax structures. This makes it easier to collect taxes.

Updates for Specific Sectors:

New rules have been put in place for new industries like e-commerce, digital services, and green energy.

Measures to Improve Compliance

Data Integration:

Provincial systems can now connect to federal records to make it easier to find taxpayers and make sure they are following the rules.

Automated Reminders:

Electronic systems that tell taxpayers of due dates and other obligations let them know.

Penalty Rationalisation:

To find a balance between deterrence and policies that are good for taxpayers, some governments have changed the way penalties work.

Measures of the COVID-19 Effects

Relief Packages:

During the pandemic, special steps were put in place to help people, such as delaying payments and lowering fines.

Economic Recovery Support:

Help for businesses that have been hurt by the economy, such as tax breaks for professionals.

Flexible Payment Terms:

Businesses can deal with cash flow problems by offering longer payment terms and the choice to pay in installments.

What it means for different types of businesses

Different types of businesses are affected by professional tax in different ways, which creates both problems and chances in Pakistan’s economy.

Effects on the Healthcare Sector

Private business:

Individual doctors have to pay a professional tax based on how much money they make from their business. This can change how they set prices and provide services.

Healthcare Facilities:

Clinics and hospitals have to deal with professional tax obligations, as well as complicated healthcare rules and prices.

Pharmaceutical Industry:

Businesses in the pharmaceutical industry have to deal with professional tax rules while keeping prices for vital medicines low.

Sector for Legal Services

Law Firms:

Legal firms have to find a balance between the prices of professional taxes, how much they charge clients, and the pressures of the market.

Individual Lawyers:

As a sole practitioner, your earnings are directly affected by professional taxes, which can affect your career and practice choices.

Corporate Legal Departments:

In-house legal teams add to the overall professional tax responsibilities of a company.

[Table suggestion: Professional Tax Impact Analysis by Sector]

Average Tax Burden Compliance Difficulty Growth Effects on Business

Healthcare High Moderate to High

Legal Services Medium Low Medium Medium

Low- to medium-level negativity in information technology

High Moderate High Manufacturing

Retail Trade Moderate Moderate Moderate

Sector of information technology

Software Companies:

IT companies get a lot of tax breaks and help the government earn money through professional taxes.

Individual IT experts who work as freelancers have to deal with professional tax rules while competing in global markets.

Startups:

Technology companies use exemptions and discounts to lower their start-up costs.

Sector of Manufacturing

Industrial Units: Manufacturing companies have big professional tax bills that depend on how many employees they have and how often they sell their products.

Export Industries:

Different tax breaks and reward programs help manufacturers who focus on exports.

Small and Medium-Sized Businesses:

Lower professional tax rates help small and medium-sized businesses.

Strategies for Businesses to Follow the Law

Professional tax compliance that works requires careful planning and consistent application in a variety of business settings.

Framework for Organizational Compliance

Dedicated Tax Teams:

Bigger businesses can benefit from having dedicated tax compliance teams that know exactly what the local rules are.

Professional Advisory Services:

Hiring qualified tax advisors makes sure that you follow the rules and minimizes your tax responsibilities through legal planning strategies.

Integrated Systems:

These days, businesses use accounting and tax systems that work together so that they easily keep track of their professional tax obligations.

Writing things down and keeping records

Full Records:

Keeping full records of your income, spending, and tax payments helps you stay in compliance and protects you from audits.

Digital Documentation:

Systems that keep records electronically are more efficient and give tax officials better audit trails.

Regular Updates:

Making regular changes to voter information makes sure it is correct and avoids problems with compliance.

[Image suggestion: A business team in a modern office looking over tax papers to make sure they are correct]

Measures to Ensure Compliance

Reviewing professional tax obligations on a regular basis can help you see if your liability has changed and make sure you’re meeting your responsibilities on time.

Training Programs:

Teaching employees about professional tax requirements improves the culture of compliance in a business and cuts down on mistakes.

Utilizing Technology:

Making use of available technology platforms speeds up legal processes and lowers the administrative load.

Strategies for Managing Risk

Compliance Audits:

Regular internal audits find possible gaps in compliance and give people a chance to fix them.

Avoiding Penalties:

The main goal of proactive compliance methods is to stay away from penalties by making payments on time and giving correct information.

Professional Networks:

Keeping in touch with tax experts and trade groups can help you learn a lot about compliance.

Common Problems and How to Fix Them

Professional tax compliance in Pakistan comes with a lot of issues that companies and professionals need to solve quickly.

Challenge 1: The complexity of provincial variation

The Problem: Different provinces have different rules, fees, and requirements, which makes activities that involve more than one province difficult.

How to Fix It:

- Make compliance calendars and procedures that are unique to each province.

- Hire local tax experts in each area where you do business.

- Set up centralized tracking tools for obligations that span multiple provinces.

- Staff get regular training on how local differences affect them

Challenge 2: Writing things down and keeping records

The Problem: Not having enough paperwork can make it hard to follow the rules and could lead to fines during exams.

How to Fix It:

Set up complete methods for managing documents.

Tax records should be backed up and stored regularly.

Staff training on what paperwork is needed and how to do things right.

Professional review of how well the paperwork is done.

Issue 3: When to pay and how much cash flow

The Problem: The due dates for professional taxes might not match up with the cash flow cycles of businesses, which can put a strain on their finances.

How to Fix It:

- Make a cash flow forecast that takes into account your tax responsibilities.

- Set up special funds for paying taxes

- If you can, look into choices for making payments over time.

- Think about how professional taxes will affect your business plans.

[Chart idea: a flowchart that shows common tax problems for professionals and how to solve them step-by-step]

Changes and updates to rates are Challenge 4.

The Problem: Professional tax rates and methods change all the time, which makes it hard to know what to do when taxes are due.

How to Fix It:

- Sign up to receive official alerts from the provincial revenue department

- Continue to work with professional tax experts.

- Tax needs and rate changes should be looked at regularly.

- Set up processes that are flexible enough to adapt to changes in the law.

Challenge 5: Adopting new technology

The Issue: The switch to digital systems makes things harder for older professionals and traditional companies.

How to Fix It:

Adopting technology slowly while getting the right training

Help from professionals with digital legal needs

During transition times, keep hybrid systems up and running.

Spend money on technology that is easy for people to use.

Tips from Tax Experts on How to Do Your Job

Based on a lot of knowledge with Pakistani tax law, here are some important suggestions for professional tax management that work.

For Professionals Working Alone

Tracking Income:

Keep careful records of all professional income from all sources to make sure you pay your taxes correctly and follow the rules.

Quarterly Reviews:

Check your professional tax obligations every three months to see if your responsibility has changed and make sure you pay on time.

Professional Development:

To stay up to date on changes to professional taxes, keep learning and reading information from professional organizations.

Advisory Relationships:

Get to know qualified tax advisors who understand the difficulties and circumstances of your job.

Used by small and medium-sized businesses

Integrated Planning:

Have a professional do your taxes as part of your business’s overall financial planning and spending.

Training for Employees:

Make sure everyone in the company knows about professional tax standards and how to follow them by training the right people.

Technology Investment:

Spend money on the right technology solutions that make it easier for professionals to file their taxes and make administration easier.

Regular Audits:

To find and fix possible problems before they happen, do regular internal audits of professional tax compliance.

[Suggested info-graphic: a list of the best tax management techniques for businesses of all sizes]

As for Big Businesses

Organized Management:

Set up professional tax management systems that are organized and make sure that all provinces and business units are following the rules.

Specialized Teams:

Create tax teams that are experts in professional tax rules and differences between provinces.

Risk Assessment:

Regularly look at the risks of professional tax compliance to find and fix any problems that might come up.

Strategic Planning:

Think about professional taxes when you plan your business’s growth and make strategic decisions about it.

For people who work in and advise on taxes

Continuous Learning:

Regular training and professional development will help you keep up with changes in professional taxes in all states.

Client Education:

Teach your clients about the professional tax rules they need to follow and help them come up with good ways to follow them.

Use of Technology:

Use the technology tools that are available to improve how you provide services and help clients follow the rules.

Professional Networks:

Stay up to date on changes in your field by staying involved in professional networks and associations.

Ideas for the Future and Trends

Pakistan’s professional tax scene is always changing because of new technologies, the need for economic growth, and attempts to make government more modern.

Trends in Using Technology Together

Artificial Intelligence:

In the future, systems may include assessment and compliance tracking tools powered by AI to make them more accurate and useful.

Blockchain Technology:

It’s possible that blockchain-based systems could be used to make professional tax records more open and safe.

Approach Based on Mobile Devices:

Keeping working on mobile-first solutions that offer full professional tax services through smartphone apps.

Data Analytics:

Better use of data analytics to create profiles of taxpayers, keep an eye on compliance, and predict income.

Policy Development: Where to Go

Harmonization Efforts:

There may be steps taken to make professional tax policies more similar across provinces, while still letting each province keep its own identity.

Structures Simplified:

Professional tax structures are still being simplified to make them easier to follow and to collect taxes more quickly.

Reward Expansion:

Increasing reward programs for certain industries, areas, or groups of people in order to help the economy grow.

Thoughts on the Economic Impact

Income Growth:

As economies become more formal, the professional tax is likely to become a more important source of income for provincial governments.

Business Environment:

More work needs to be done to make professional tax systems more business-friendly in order to bring in investment and urge people to start their own businesses.

Digital Economy:

Professional tax systems need to change to keep up with the growing digital economy and new types of professional services.

Changes in Compliance

Automatic Compliance:

The move toward automatic compliance systems that require less work from humans and are more accurate.

Real-Time Monitoring:

Creating systems that check for compliance in real time and give taxpayers and authorities instant feedback.

Predictive Analytics:

Find compliance risks and help people before they need it by using predictive analytics.

Takeaway:

Pakistan’s professional tax is an important part of the country’s provincial revenue systems, and it has a direct effect on millions of professionals and companies across the country. As Pakistan moves further toward economic modernization and digital transformation, it becomes more important for professionals to understand and properly handle their tax responsibilities in order to stay in good financial standing and follow the law.

Different provincial methods to professional tax show how Pakistan is set up as a federal country and how each region’s economy is different. This variety makes things more difficult, but it also makes it possible to find solutions that work for each place’s unique wants and circumstances. The ongoing digitization efforts across all provinces are making compliance easier to reach and faster. However, because regulations are always changing, it is still important to get professional help.

[Image suggestion: a modern cityscape in Pakistan with a digital layer that shows how tax systems have changed with the times]

Planning ahead, having good records, and staying up to date on changes to the tax laws are the keys to good professional tax management for businesses and professionals. Putting money into good compliance systems and professional advisory relationships pays off in the form of lower fines, better cash flow management, and a better image for the business.

Pakistan’s professional tax system is likely to become more integrated, with procedures made easier and services for taxpayers better in the future. Technology will continue to be a key part of making compliance more efficient and easing the administrative load on both taxpayers and authorities. The provinces that can find a good balance between policies that help businesses and policies that bring in money will probably see faster economic growth and better compliance rates.

As Pakistan’s economy continues to grow and become more organised, the professional tax will remain a key way for regional governments to pay for public services and development projects. Pakistan’s economy is changing quickly, and professionals and companies that understand and adapt to this will be in a better position to do well.

Recent reforms put a lot of focus on being open, efficient, and providing good service to taxpayers. This makes me think that future changes will aim to make things better for everyone, so that compliance is easy and money is collected more efficiently. This change is good for everyone involved and helps Pakistan reach its larger economic growth goals.

For the best professional tax management and compliance strategies that are tailored to your unique situation, professional advice is still the best way to get through Pakistan’s complicated system of different provincial tax systems.

Visit https://taxaccountant.pk/ or call our experienced team to get personalised help with professional tax compliance, planning strategies, and managing taxes in more than one province. Our experts know a lot about Pakistani tax law and can help you make the most of your professional tax obligations while still making sure you follow the rules to the letter.

About the Author:

Umair A R Mughal is a skilled writer who focuses on Pakistani tax law and business compliance. He helps people figure out how to deal with Pakistan’s complicated tax system by giving them advice based on his deep knowledge of state tax systems and professional tax requirements.

2 thoughts on “Professional Tax in Pakistan”