Streamline Your Business Tax Compliance: Expert NTN Registration Services for Business Individuals in Pakistan

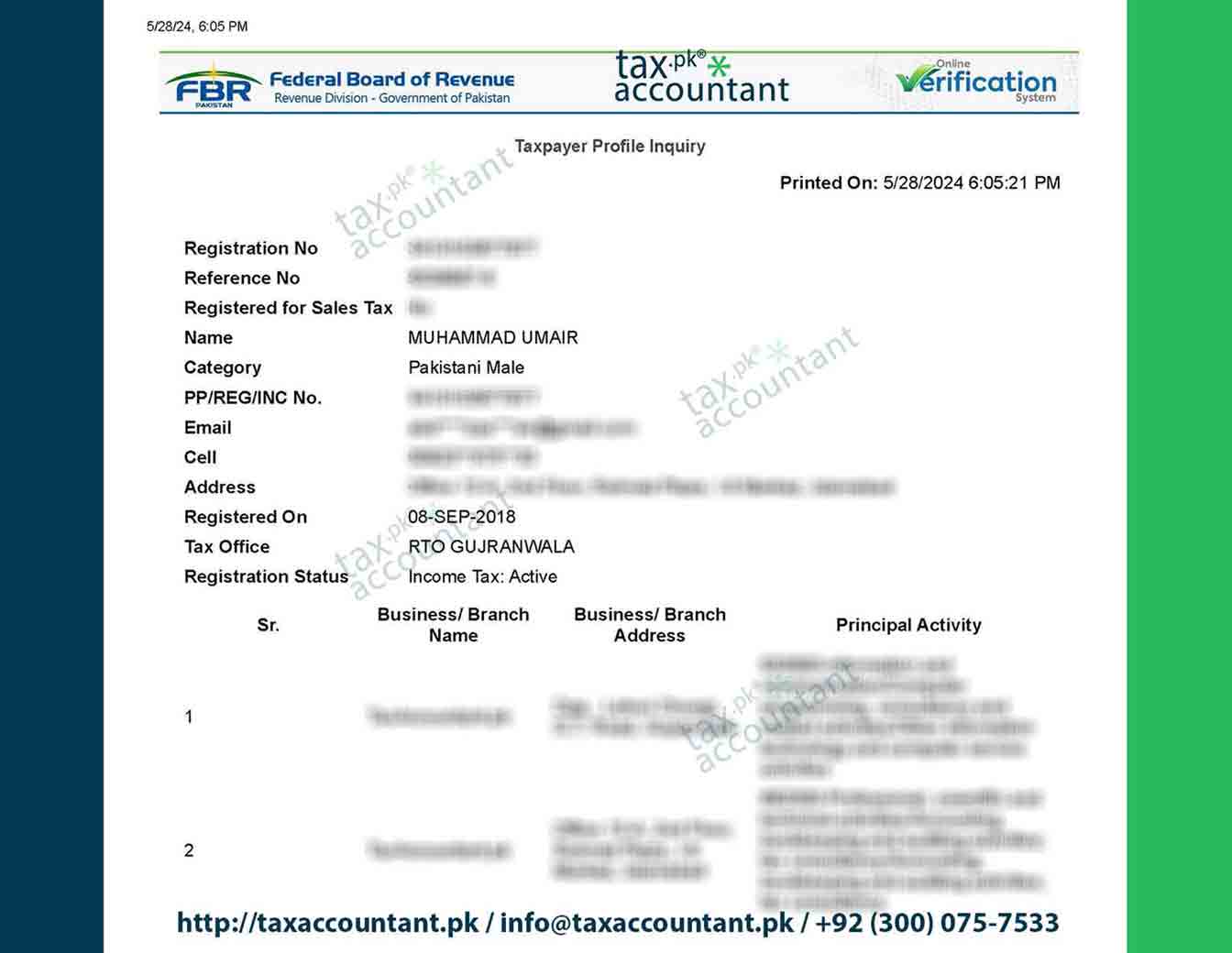

At TaxAccountant.pk, we understand that navigating the intricacies of tax compliance can be a daunting task for business individuals in Pakistan. That’s why we offer specialized services to streamline the NTN (National Tax Number) registration process, ensuring your business is fully compliant with Pakistani tax laws and regulations. Our team of tax experts is dedicated to guiding you through the process, saving you valuable time and effort.

Why Choose TaxAccountant.pk for NTN Registration?

- In-depth Tax Knowledge: Our experts possess comprehensive knowledge of Pakistani tax laws and regulations, ensuring your NTN application is accurate and compliant.

- Personalized Guidance: We offer one-on-one support throughout the registration process, addressing your specific questions and concerns.

- Efficient Application Processing: We handle all necessary documentation and communication with the Federal Board of Revenue (FBR), saving you time and effort.

- Error-Free Submission: Our meticulous approach ensures your application is complete and error-free, minimizing delays and potential issues.

- Ongoing Tax Support: We provide continuous support with tax filings, compliance, and any tax-related queries you may have.

Benefits of NTN Registration for Business Individuals:

- Legal Compliance: An NTN is mandatory for filing tax returns and fulfilling your tax obligations as a business individual.

- Business Credibility: Demonstrates your commitment to financial transparency and builds trust with customers and partners.

- Access to Financial Services: An NTN is often required for opening business bank accounts, obtaining loans, and participating in government tenders.

- Tax Benefits: Certain tax deductions and exemptions may be available only to NTN holders.

- Simplified Business Operations: An NTN streamlines your interactions with tax authorities and other government agencies.

Liabilities & Considerations:

- Tax Obligations: Obtaining an NTN makes you liable for filing annual tax returns and paying applicable taxes based on your business income.

- Penalties for Non-Compliance: Failure to file tax returns or pay taxes on time can result in penalties and legal consequences.

- Accurate Record-Keeping: It’s crucial to maintain meticulous records of your business income and expenses for tax purposes.

Required Documents for Business Individuals:

- Valid CNIC (Computerized National Identity Card)

- Proof of business address (utility bill, rent agreement, etc.)

- Bank statement (in the name of the business)

- Proof of business activity (e.g., shop registration certificate, professional license)

- Partnership deed (if applicable)

Let TaxAccountant.pk simplify your tax journey. Contact us today for expert NTN registration services and comprehensive tax support for your business.

FAQs

Who is considered a business individual for NTN registration?

A: Individuals engaged in any commercial, industrial, or professional activity are considered business individuals.

Can I apply for NTN online?

Yes, you can apply online through the FBR’s IRIS portal, and TaxAccountant.pk can assist you with the process.

How long does it take to get an NTN?

The processing time varies, but TaxAccountant.pk typically obtains NTNs within a few working days.

What if I change my business address?

You need to update your business address with the FBR through their online portal or by visiting a tax facilitation center.

Do I need to renew my NTN?

No, your NTN is valid for life unless you cease business operations or change your business structure.