Simplify Your Partnership/AOP Tax Compliance with TaxAccountant.pk

Introduction

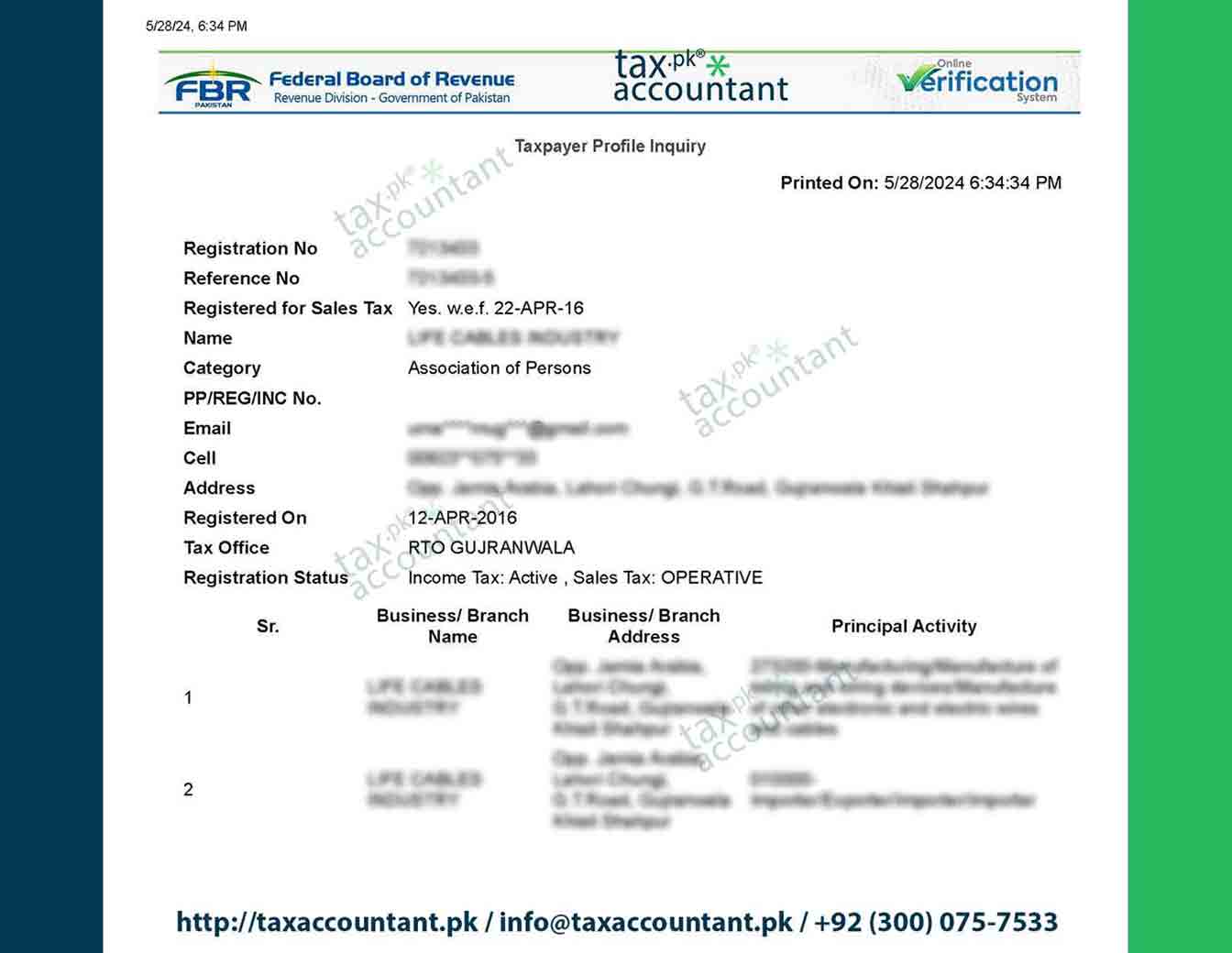

At TaxAccountant.pk, we understand the unique challenges faced by partnerships and Associations of Persons (AOPs) in navigating Pakistan’s tax landscape. Obtaining a National Tax Number (NTN) is a crucial first step towards legal operation and tax compliance. Our dedicated team of experts is here to guide you through the entire NTN registration process, ensuring a smooth and hassle-free experience.

Why Choose TaxAccountant.pk for Partnership/AOP NTN Registration?

- In-depth Expertise: Our tax professionals possess extensive knowledge of the specific regulations and requirements for partnership and AOP registrations, ensuring your application is accurate and compliant.

- Personalized Guidance: We offer one-on-one support throughout the entire process, addressing your specific concerns and providing clarity on complex tax matters.

- Efficient Processing: We handle all necessary documentation and communication with the Federal Board of Revenue (FBR), saving you valuable time and effort.

- Error-Free Submission: Our meticulous approach ensures your application is complete and free from errors, minimizing delays and potential issues.

- Ongoing Support: We offer continuous assistance with tax filings, compliance, and any partnership/AOP-related tax queries you may have.

Benefits of NTN Registration for Partnerships/AOPs:

- Legal Compliance: An NTN is mandatory for filing tax returns and fulfilling your tax obligations as a partnership or AOP.

- Enhanced Credibility: Demonstrates your commitment to financial transparency and builds trust with stakeholders, partners, and clients.

- Access to Financial Services: An NTN is often required for opening bank accounts, obtaining loans, and participating in government tenders.

- Tax Benefits: Certain tax deductions and exemptions are exclusively available to NTN holders, potentially reducing your overall tax burden.

- Simplified Business Operations: An NTN streamlines your interactions with tax authorities and other government agencies.

Liabilities & Considerations:

- Joint and Several Liability: Partners in a partnership or AOP are jointly and severally liable for the entity’s tax obligations.

- Profit-Sharing: The NTN registration process requires accurate information on the profit-sharing ratio among partners/members.

- Penalties for Non-Compliance: Failure to file tax returns or pay taxes on time can result in penalties and legal action against the partnership/AOP and its partners/members.

Required Documents:

- Partnership deed or agreement (clearly defining the terms of the partnership/AOP)

- CNIC copies of all partners/members

- Proof of business address (utility bill, rent agreement, etc.)

- Bank statement in the name of the partnership/AOP

- Proof of business activity (if applicable)

Contact TaxAccountant.pk today for expert NTN registration services and comprehensive tax support for your partnership or AOP.

FAQs

Can an unregistered partnership/AOP obtain an NTN?

Yes, but it may require additional documentation and verification by the FBR.

How is the income of a partnership/AOP taxed?

The income is taxed as pass-through income, meaning profits and losses are distributed to the partners/members and taxed on their individual tax returns.

What is the tax rate for partnerships/AOPs in Pakistan?

The tax rate varies based on the total income and the applicable tax slabs. TaxAccountant.pk can help you determine your specific tax rate.

Can a partnership/AOP convert to a company?

Yes, but it requires specific procedures and approvals from the FBR. TaxAccountant.pk can assist with this process.

What are the consequences of not obtaining an NTN for a partnership/AOP?

Non-compliance can lead to penalties, legal issues, and restrictions on business activities.