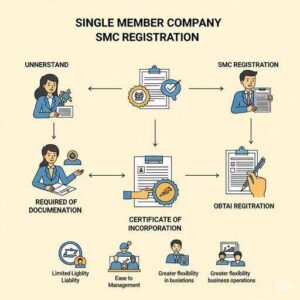

Solo Flight to Success: Your Guide for a Single Member Company (SMC) Registration in Pakistan

Dreaming of launching your own business, but wary of the complexities of traditional company structures or the unlimited liability of a sole proprietorship? Pakistan’s Single Member Company (SMC) offers a compelling solution, empowering individual entrepreneurs to operate with the benefits of a limited liability company.

In recent years, the SMC has gained significant traction, and for good reason. It’s a modern, efficient, and secure way to formalize your solo venture. But what exactly is an SMC, and how do you go about registering one? Let’s dive in!

What is a Single Member Company (SMC)?

At its core, an SMC is a private limited company that has only one member (shareholder). This individual is the sole owner and director, giving them complete control over the business’s operations and strategic direction. The key differentiator from a sole proprietorship is the concept of limited liability. This means that the personal assets of the sole shareholder are separate from the company’s liabilities. Should the company incur debts or face legal issues, the shareholder’s personal wealth (like their home or savings) is generally protected.