The Federal Board of Revenue (FBR) in Pakistan has established new income tax slabs for the fiscal year 2024-2025. These changes reflect the government’s ongoing efforts to adjust tax rates in response to economic conditions, inflation, and the financial burden on salaried individuals.

In this blog post guide, we will provide you a comprehensive overview of the current income tax slabs, their implications for taxpayers, and strategies for effective tax planning.

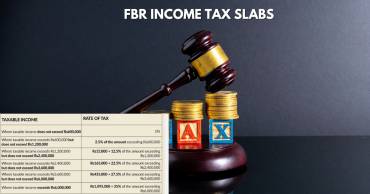

Overview of Income Tax Slabs

The income tax slabs for salaried individuals have been structured to ensure a progressive taxation system. Below are the detailed slabs applicable for the fiscal year 2024-2025:

| Taxable Income |

Rate of Tax |

| Up to Rs. 600,000 |

0% |

| Rs. 600,001 – Rs. 1,200,000 |

5% of the amount exceeding Rs. 600,000 |

| Rs. 1,200,001 – Rs. 2,200,000 |

Rs. 30,000 + 15% of the amount exceeding Rs. 1,200,000 |

| Rs. 2,200,001 – Rs. 3,200,000 |

Rs. 180,000 + 25% of the amount exceeding Rs. 2,200,000 |

| Rs. 3,200,001 – Rs. 4,100,000 |

Rs. 430,000 + 30% of the amount exceeding Rs. 3,200,000 |

| Above Rs. 4,100,000 |

Rs. 700,000 + 35% of the amount exceeding Rs. 4,100,000 |

These slabs indicate a gradual increase in tax rates as income rises, which is designed to alleviate the financial burden on lower-income earners while ensuring higher earners contribute a fair share.

Key Changes from Previous Years

The new tax structure has seen some significant changes compared to previous years:

- Increased Rates for Middle-Income Brackets: The tax rate for incomes between Rs. 600,001 and Rs. 1,200,000 has increased from 2.5% to 5%.

- Higher Fixed Amounts: The fixed amounts in higher brackets have also been adjusted upward to reflect inflation and economic changes.

- No Change in Exemption Threshold: The exemption threshold remains at Rs. 600,000, meaning individuals earning below this amount are not liable for income tax.

Impact on Taxpayers

Financial Implications

For many salaried individuals in Pakistan:

- Those earning up to Rs. 600,000 will not pay any income tax.

- Individuals with a salary exceeding Rs. 600,000 will see an increased tax liability compared to previous years.

- For example:

- An individual earning Rs. 800,000 will pay:

Tax=(800,000−600,000)×0.05=Rs 10,000Tax=(800,000−600,000)×0.05=Rs 10,000

- An individual earning Rs. 1 million will pay:

Tax=Rs 30,000+(1,000,000−1,2000)×0.15=Rs 30,000+Rs 120=Rs 30,120Tax=Rs 30,000+(1,000,000−1,2000)×0.15=Rs 30,000+Rs 120=Rs 30,120

Psychological Impact

The increase in taxes can lead to discontent among taxpayers who may feel that their disposable income is being eroded by higher taxation rates amidst rising living costs.

Strategies for Effective Tax Planning

To navigate the new income tax landscape effectively:

- Utilize Tax Deductions and Credits: Familiarize yourself with available deductions such as those related to education expenses or health care costs that can reduce taxable income.

- Consider Tax-Efficient Investments: Explore options like government bonds or retirement accounts that may offer tax advantages.

- Stay Informed on Tax Regulations: Regularly review updates from the FBR or consult with a tax professional to ensure compliance and optimize your tax situation.

The FBR’s revised income tax slabs for the fiscal year 2024-2025 reflect an attempt to balance revenue generation with economic realities faced by taxpayers in Pakistan.

As these changes take effect, it is crucial for individuals to understand their implications and consider proactive strategies for effective tax management.By staying informed and planning accordingly, taxpayers can mitigate the impact of these changes on their financial well-being while fulfilling their civic duties responsibly.

FAQs about FBR Income Tax Slabs

What are the current income tax slabs for salaried individuals?

The current slabs range from a zero percent rate for incomes up to Rs. 600,000 to a maximum rate of thirty-five percent for incomes exceeding Rs. 4 million.

How do I calculate my income tax based on these slabs?

To calculate your income tax:

- Identify your taxable income.

- Apply the relevant slab rates sequentially based on your total income.

Are there any exemptions available under these new slabs?

Yes! The exemption threshold remains at Rs. 600,000; therefore anyone earning below this amount is not required to pay any income tax.

How can I reduce my taxable income?

You can reduce your taxable income by utilizing available deductions and credits related to various expenses such as education and healthcare.By understanding these aspects of FBR’s income tax slabs and implementing effective strategies for managing your finances within this framework, you can navigate your financial obligations more effectively in the coming year.

What are the benefits of becoming a filer in Pakistan?

Becoming a tax filer in Pakistan comes with numerous advantages that can significantly enhance financial management and reduce tax liabilities. The Federal Board of Revenue (FBR) encourages citizens to file their taxes by offering a variety of benefits that are not available to non-filers. Here’s an in-depth look at the benefits of becoming a filer in Pakistan.

Key Benefits of Being a Filer

1. Reduced Tax Rates

One of the most significant benefits of being a tax filer is the reduced tax rates applicable to various transactions:

- Bank Transactions: Filers are exempt from withholding tax on bank transactions such as demand drafts, while non-filers are charged Rs. 600 per transaction.

- Cash Withdrawals: For cash withdrawals exceeding Rs. 50,000, filers pay a reduced rate of 0.3% compared to 0.6% for non-filers.

- Bank Profits: The tax on profits from savings accounts is 10% for filers, whereas non-filers pay 15%.

2. Lower Duties on Imports and Exports

Filers enjoy lower duties when engaging in import and export activities:

- Import of Raw Materials: Filers pay only 5.5% on raw material imports compared to 8% for non-filers.

- Commercial Exports: Exporters who are filers pay 6% duty, while non-filers face a 9% duty.

3. Favorable Tax Treatment on Property Transactions

The tax implications for property transactions are significantly more favorable for filers:

- Property Purchase: Filers pay a reduced rate of 1% on property purchases, while non-filers are taxed at 2%.

- Transfer of Property: The tax on property transfers is only 1% for filers compared to 2% for non-filers.

4. Tax Benefits on Prize Bonds and Commissions

Filers also benefit from lower taxes on prize bonds and commission earnings:

- Prize Bonds: Tax on winnings from prize bonds is 15% for filers, whereas non-filers pay 30%.

- Commission Earnings: Filers are taxed at 12% on commissions, while non-filers face a rate of 24%.

5. Vehicle Registration and Annual Token Tax Benefits

When it comes to vehicle-related taxes, filers have substantial advantages:

- Vehicle Registration: Filers pay significantly lower withholding taxes when registering vehicles compared to non-filers.

- Annual Token Tax: The annual token tax for filers ranges from Rs. 800 to Rs. 10,000, while non-filers may pay between Rs. 1,200 to Rs. 30,000 depending on the vehicle’s engine capacity.

6. Better Access to Financial Services

Being a filer opens up opportunities for better financial services:

- Loan Applications: Filers often have an easier time securing loans or credit facilities as they demonstrate compliance with tax regulations.

- Business Operations: Many businesses require proof of tax compliance for contracts and transactions, making filer status essential for entrepreneurs.

7. Ability to Claim Tax Credits and Adjustments

Filers can take advantage of various tax credits and adjustments that are not available to non-filers:

- Withholding Tax Adjustments: Filers can adjust withholding taxes paid against their total income tax liability, reducing their overall tax burden.

- Tax Credits: Eligible expenses such as donations to approved charities or contributions to retirement funds can provide additional tax credits for filers.

Becoming a filer in Pakistan not only fulfills civic responsibilities but also unlocks numerous financial benefits that can lead to substantial savings. From reduced tax rates on various financial transactions to better access to loans and business opportunities, the advantages are compelling. For anyone considering filing their taxes, the process is straightforward and offers significant long-term benefits.